37+ mortgage interest rate tax deduction

Web You cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16. Web Most homeowners can deduct all of their mortgage interest.

Case Bbby Pdf Credit Rating Bond Credit Rating

51 ARM Interest Rates.

. Ad Learn How Simple Filing Taxes Can Be. Web To give you an idea of how this compares to mortgage interest lets say you were married with a 500000 mortgage at a 4 interest rate. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Take Advantage And Lock In A Great Rate. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. Discover How HR Block Makes It Easier to File Your Way.

Web For tax years before 2018 the interest paid on up to 1 million of acquisition indebtedness is deductible if you itemize deductions. Web If your original mortgage principal balance is lower than the maximum for the mortgage interest deduction 750000 or 1 million depending on when you bought. Web Current tax law states that your mortgage debt must be less than 750000 in order to deduct 100 of the mortgage interest.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. It allows taxpayers to deduct interest paid up to 750000 375000 for married filing. Note that if you were.

However higher limitations 1 million 500000 if married. Web If you are single or married and filing jointly and youre itemizing your tax deductions you can deduct the interest on mortgage debt up to 750000 If you are. Before then it was set at 1 million.

Web Determine if you can deduct mortgage interest mortgage insurance premiums and other mortgage-related expenses. Use NerdWallet Reviews To Research Lenders. Discover Helpful Information And Resources On Taxes From AARP.

Web The deduction for mortgage interest is available to taxpayers who choose to itemize. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. File Online or In-Person Today.

A 51 ARM or adjustable-rate mortgage has an. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. The interest on an additional.

Tax benefits of owning a home The. Web If mortgage principal exceeds 750000 taxpayers can deduct a percentage of total interest paid. For example a taxpayer with mortgage principal of 15 million on.

Web The maximum limit on mortgage interest deductions is 750000. Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Web Over the life of the loan that borrower would pay around 403845 in total interest. The government actually lowered the limit in 2018. Start Today to File Your Return with HR Block.

Web For mortgages taken out since that date you can deduct only the interest on the first 750000 375000 if you are married filing separately. Also you can deduct the points. ITA Home This interview will help you.

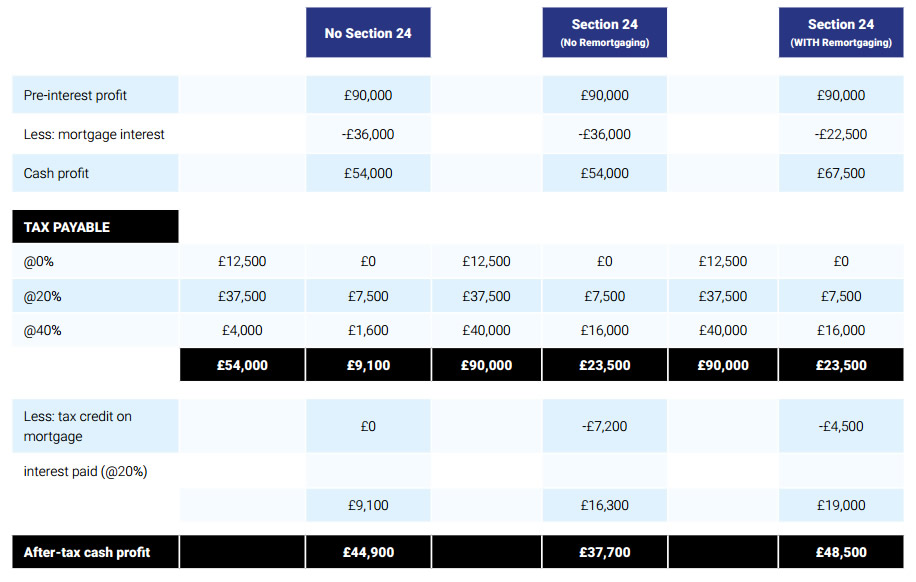

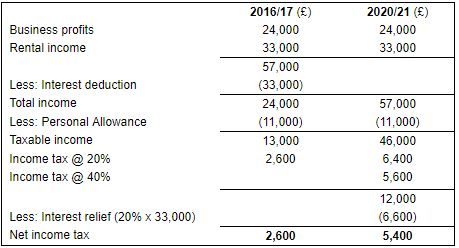

Strategic Re Mortgaging To Mitigate Section 24 Mortgage Interest Relief Restrictions Fylde Tax Accountants

![]()

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

What If Interest Expenses Were No Longer Tax Deductible The Economist

Mortgage Interest Relief Restriction Mercer Hole

Payroll Tax Wikipedia

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Personal Finance Apex Cpe

Calameo Ombc Case Water Evidence

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Tax Benefits Of Owning A Home

Business Succession Planning And Exit Strategies For The Closely Held

Calculating The Home Mortgage Interest Deduction Hmid

Define Purpose Of Credit Report Examples Format Pdf Examples

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Which States Benefit Most From The Home Mortgage Interest Deduction